Nvidia's Rubin Platform, Meta's $2B Agent Bet, & Anthropic Hits $350B

Rubin ships early after Blackwell's rocky launch, robots finally get real timelines, Meta's $2B Manus deal triggers China probe, and Anthropic doubles to $350B

Nvidia Accelerates Rubin as Blackwell Stumbles

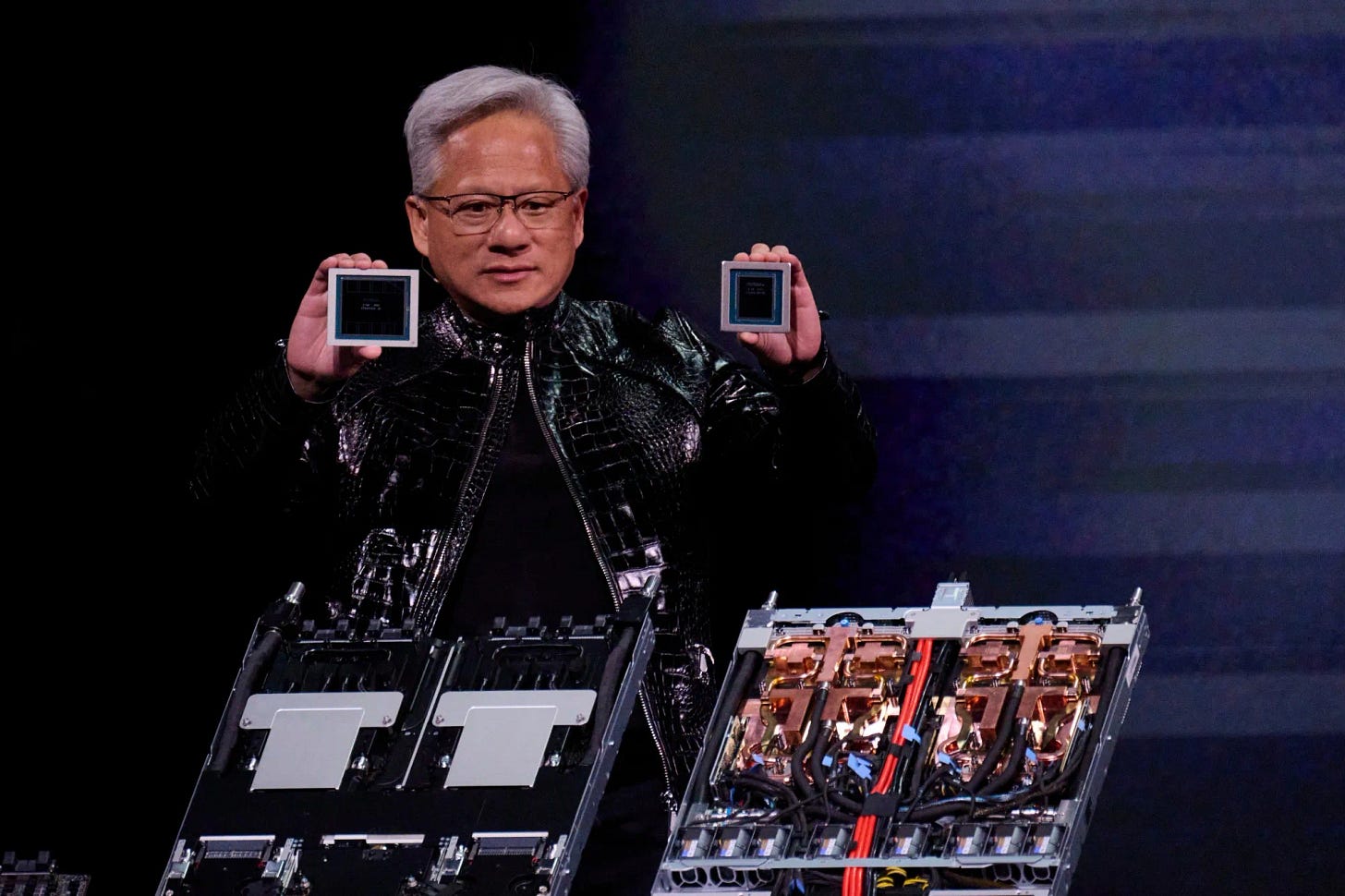

Jensen Huang opened CES 2026 at the Fontainebleau Las Vegas with Rubin, Nvidia’s successor to Blackwell and its most complex AI platform to date.

Rubin delivers up to 5x the inference performance and 3.5x the training throughput of Blackwell. More importantly, it cuts token costs by 10x, making inference a lot more manageable.

A full rack delivers 3.6 exaflops of inference compute. For context, that’s roughly the performance of a top-10 supercomputer from 2020.

Nvidia built Rubin specifically for mixture-of-experts models (MoE), which combine specialized “expert” sub-models and route queries to the appropriate one. This architecture powers many frontier reasoning models. Nvidia claims Rubin can train MoE models with 4x fewer GPUs than Blackwell and run inference at one-seventh the token cost.

Rubin is already in full production as of Q1 2026, ahead of earlier guidance. They probably moved fast because Blackwell has been a rocky launch.

Jensen Huang admitted to design flaws that caused overheating in 72-GPU server racks, forcing redesigns and delaying shipments to Microsoft, Google, and Meta. No frontier model has been trained on Blackwell yet. Meanwhile, Google trained Gemini 3 entirely on its own TPUs.

Nvidia keeps absorbing adjacent markets by using GPU dominance as a wedge. As I wrote in December, the Groq acquisition was part of the same playbook. Rubin is extending it further.

The BlueField4 DPU and "AI-Native Storage Infrastructure" was the most interesting part of the announcement. The new storage architecture is basically the opposite of the Groq deal. Groq trades memory for speed, while this trades speed for way more memory.

Jensen Talks Robots Again, This Time with Timelines

The second half of Huang’s keynote focused on what Nvidia calls “physical AI,” models trained in simulation that deploy to robots and autonomous vehicles.

“The ChatGPT moment for robotics is here,” Huang said, unveiling Cosmos, a foundation model trained on massive datasets to simulate environments governed by actual physics. Alongside it, Nvidia released updated GR00T models for humanoid robot learning and Alpamayo, a model designed for autonomous driving.

Jensen Huang made a similar claim a year ago. Given how fast AI is progressing, this time might be different.

Boston Dynamics backed up the pitch by publicly demonstrating its humanoid robot Atlas for the first time. A production version will deploy at Hyundai’s electric vehicle plant near Savannah, Georgia by 2028.

IntBot ran its entire booth with Nylo, a humanoid that autonomously greeted visitors and answered questions with no human handlers.

Other notable debuts: NEURA Robotics showed a Porsche-designed humanoid, AMD brought Generative Bionics’ GENE.01 robot onstage, and Richtech launched Dex, a mobile humanoid for industrial environments.

Nvidia’s open-source models could accelerate the ecosystem the same way PyTorch did for deep learning, giving smaller players the building blocks to compete.

Alpamayo is vision-only, with no LiDAR required. Nvidia, like Tesla, is especially motivated to make vision-only work because fewer hardware requirements means a bigger addressable market.

Meta Buys Manus for $2B as China Launches Investigation

Meta is acquiring Manus, the Singapore-based AI agent startup, for between $2 billion and $2.5 billion (including a $500 million employee retention pool). One day later, China’s Ministry of Commerce announced an investigation into potential export control violations.

Manus, founded in China before relocating to Singapore, gained attention earlier this year for its general-purpose AI agent that handles tasks like resume screening, trip planning, and stock analysis. Backed by Tencent, ZhenFund, and HSG, the company became a poster child for China’s AI agent capabilities. That’s exactly why Beijing is now scrutinizing the deal.

Meta says there will be “no continuing Chinese ownership interests” after the transaction closes, and Manus will discontinue operations in China. CEO Xiao Hong will report to Meta COO Javier Olivan.

The acquisition is Meta’s clearest move yet from chatbots to agents. The company has committed $60-65 billion to AI investments and shown increasing willingness to acquire rather than build. Seeing how far behind Meta is, they have no choice but to buy.

Beijing has blocked US acquisitions before, including Intel's attempted purchase of Tower Semiconductor. This investigation extends that pattern to Chinese-founded companies that relocated abroad. Cross-border M&A has been difficult for years, with the UK blocking Microsoft-Activision and the EU regularly challenging US tech deals. Washington hasn't objected to Meta's acquisition, unsurprisingly, given the ongoing tariff dispute and the chance to pull AI talent away from China.

Anthropic Nearly Doubles Valuation to $350 Billion

Anthropic has signed a term sheet for a $10 billion funding round at a $350 billion valuation, nearly doubling from the $183 billion it commanded just three months ago.

Coatue and Singapore sovereign wealth fund GIC are leading the round. This would be Anthropic’s third mega-raise in 12 months, following a $3.5 billion Series E in March 2025 at $61.5 billion and a $13 billion Series F in September.

The valuation growth reflects investor confidence in Anthropic’s efficiency thesis. While OpenAI has made $1.4 trillion in headline compute commitments, Anthropic President Daniela Amodei has argued publicly that the next phase won’t be won by the biggest pre-training runs alone, but by who can deliver the most capability per dollar of compute.

Anthropic ended 2025 with approximately $9 billion in ARR, with internal expectations pointing to nearly 3x growth in 2026. The company has reportedly hired a law firm to prepare for a potential IPO later this year, which would make this round its last as a private company.

The $350 billion valuation puts Anthropic in direct competition with OpenAI for the title of most valuable AI company. OpenAI’s $500 billion valuation remains higher, but Anthropic’s growth rate is faster. And its enterprise positioning resonates with buyers who want frontier capability without the drama.

“Rubin delivers up to 5x the inference performance and 3.5x the training throughput of Blackwell. More importantly, it cuts token costs by 10x, making inference a lot more manageable.”

this is the kind of update we need. really cool to see this.