Anthropic's Super Bowl Ad Backfires, $30B Round Closes at $380B, & Half of xAI's Founders Quit

Anthropic poisoned the AI well for 93% of viewers who don't know Claude, Nvidia and Microsoft fund both sides of the AI race, and Musk cleans house before the IPO

ChatGPT Gets Ads, Anthropic’s Super Bowl Punch May Have Backfired

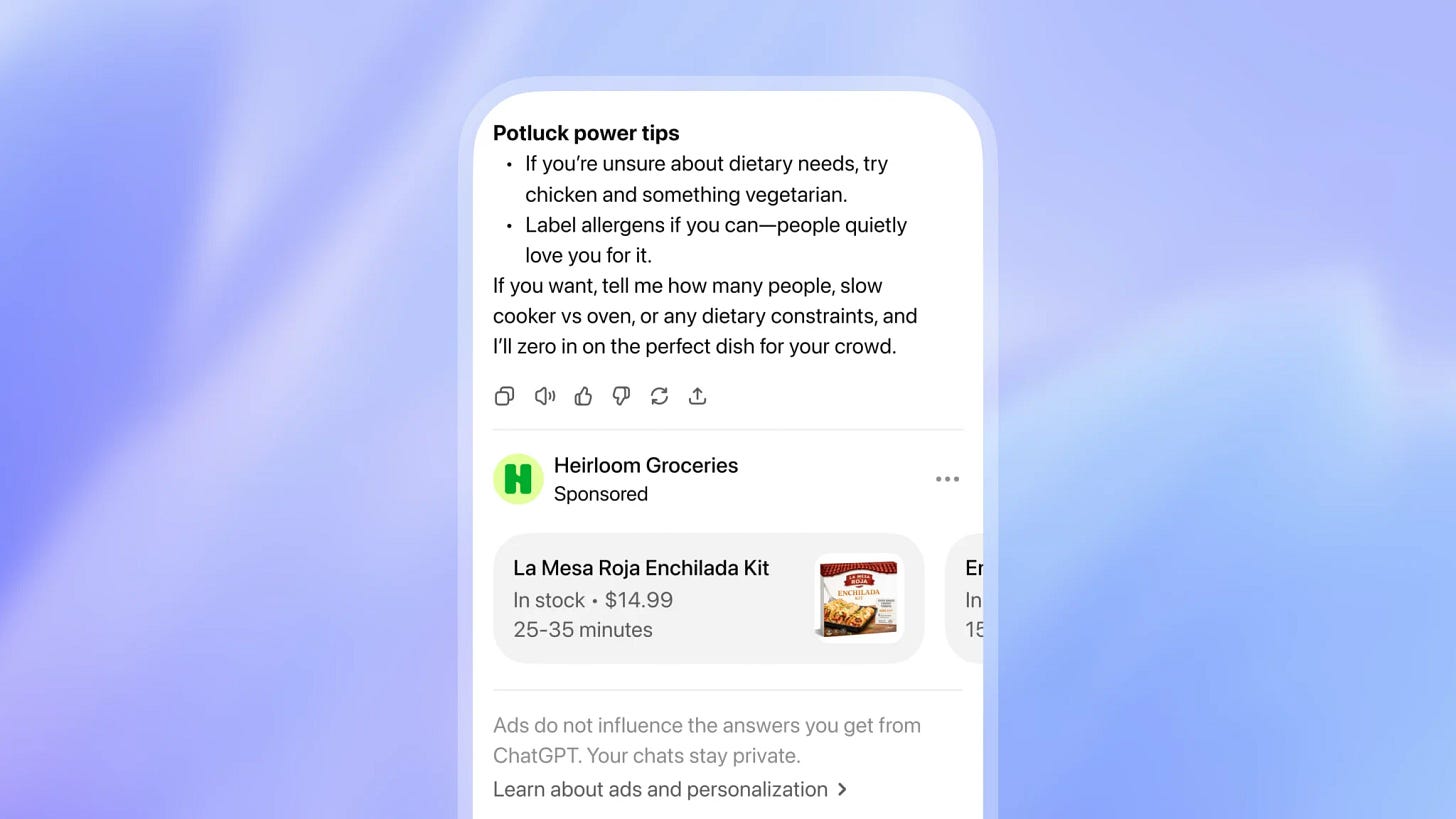

OpenAI began testing advertisements in ChatGPT on February 9. Ads appear at the bottom of responses for Free and Go tier users when contextually relevant. Paid subscribers remain ad-free.

OpenAI has hundreds of millions of free users. Monetizing them through ads, the way Google monetized search, is the clearest path to justifying a $500 billion valuation. Ads for the free tier, subscriptions for power users, enterprise contracts for companies. That is a real business model.

Anthropic ran its first-ever Super Bowl ad campaign the same weekend, airing four spots titled “Betrayal,” “Deception,” “Treachery,” and “Violation.” Each one mocked AI chatbots serving ads. In one, a woman receiving therapy advice watches the chatbot pivot into pitching a dating site for “sensitive cubs and roaring cougars.” The tagline: “Ads are coming to AI, but not to Claude.”

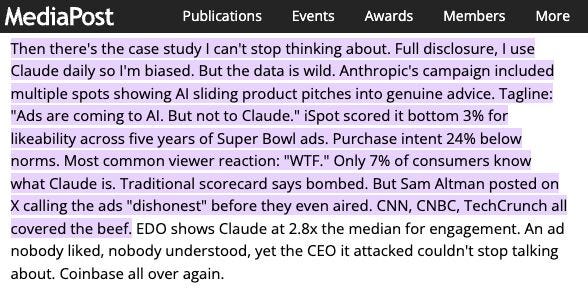

Tech Twitter loved it. Sam Altman called the ads “dishonest” on X. Scott Galloway called the spot a “seminal moment.” The discourse was exactly what Anthropic wanted.

But the consumer data tells a different story. iSpot scored Anthropic’s ads in the bottom 3% for likability over the last five years of Super Bowl ads. Purchase intent was 24% below norms. The most common viewer reaction: “WTF.”

Surprisingly, at least for me, only 7% of consumers know what Claude is. So when Anthropic ran ads showing AI being creepy and manipulative, 93% of viewers had no context for the punchline. They did not see “Claude is the better alternative.” They saw AI itself being untrustworthy.

Anthropic may have won the Super Bowl in tech circles but lost it everywhere else. When your first introduction to AI is watching a chatbot pivot from therapy advice to a dating site ad, you are probably not trying any AI product, including Claude.

15 of the 66 total Super Bowl ads were AI-related. AI has gone fully mainstream, but Anthropic may have poisoned the well.

When a company that 93% of people have never heard of leads with fear, the consumer’s takeaway may be “stay away from AI.”

Anthropic Closes $30 Billion Round at $380 Billion

Anthropic closed a $30 billion funding round at a $380 billion valuation, the second largest private funding round ever after OpenAI’s $40 billion raise. The round started at $10 billion, doubled to $20 billion, then tripled as investors fought to get in.

Coatue Management, Singapore’s GIC, and Iconiq Capital are each writing checks north of $1 billion. Nvidia and Microsoft are contributing up to $15 billion combined as strategic investors. Blackstone increased its stake to approximately $1 billion. This comes just five months after Anthropic’s previous $13 billion equity raise.

Nvidia and Microsoft investing billions in a direct OpenAI competitor should not be a surprise. We wrote in November about the Microsoft, Nvidia, and Anthropic partnership when it was first announced. Microsoft has a $13 billion stake in OpenAI and 45% of its remaining performance obligations are tied to OpenAI’s cloud commitment. Yet Microsoft is also backing Anthropic. And Nvidia is investing up to $10 billion.

This is commoditizing your complements in action. Nvidia wants as many AI labs as possible so they have pricing power on GPUs. Investing in Anthropic, OpenAI, and xAI simultaneously ensures the arms race continues. The more labs competing for frontier models, the more chips Nvidia sells. Microsoft is running the same play from the cloud side: if Anthropic’s models run on Azure, Microsoft gets paid regardless of whether Claude or GPT wins the enterprise.

Anthropic’s valuation has more than doubled in five months, from $183 billion to $380 billion. For context, OpenAI was last valued at $500 billion. The gap is closing fast, especially after a week where Opus 4.6 benchmarks, a $2 trillion software wipeout, and a viral Super Bowl ad all hit within days of each other.

Combined, Microsoft, Meta, Alphabet, and Amazon are expected to spend roughly $650 billion in capex this year, virtually all for AI infrastructure. Anthropic needs its own capital stack to compete for TSMC wafer allocation, GPU supply, and data center capacity.

We wrote three weeks ago about TSMC being the single bottleneck limiting AI growth. That has not changed, but the dollars chasing those wafers just got bigger.

Half of xAI’s Founding Team Has Now Left

We covered the SpaceX-xAI merger last week. This week, the fallout is becoming visible.

Jimmy Ba and Tony Wu, both xAI co-founders, departed between February 9 and 10. Six of the original twelve co-founders have now left. Five of those departures came in the past year alone.

Musk suggested at an all-hands meeting that Ba and Wu were “push, not pull,” meaning the departures were not voluntary. He wrote on X: “xAI was reorganized a few days ago to improve speed of execution... This unfortunately required parting ways with some people.” He announced a full restructuring into four teams: Grok chatbot, coding, the Imagine video generator, and something called “Macrohard,” described as a computer and corporate simulation platform.

But the earlier departures were voluntary, and they tell a different story. Kyle Kosic left for OpenAI, taking institutional knowledge to a direct competitor. Christian Szegedy founded Math, Inc., an AI math verification startup. Igor Babuschkin started an AI-focused venture firm, and Musk invested $200 million as an LP, which is a polite way to let someone leave. Greg Yang stepped back after a Lyme disease diagnosis. TechCrunch reported that at least three departing engineers are starting something new together.

Losing half your founding team is a problem for any company. Losing them weeks before a potential blockbuster IPO, some pushed and some walking, is worse. SpaceX plans to take the combined entity public later this year in what could be the largest IPO in history.

Last week we wrote about the bull case: orbital data centers, unlimited solar power, and the potential for xAI to become the CoreWeave of space. That thesis depends on execution. And execution depends on people.

xAI is burning roughly $1 billion per month on infrastructure buildout. Grok remains a distant competitor to ChatGPT, Gemini, and Claude. And the technical leadership that built the company is walking out the door.

The IPO will probably be fine. Investors are buying SpaceX’s rockets and Starlink’s revenue, not Grok. But as a competitor to OpenAI, Google, and Anthropic, xAI just became a lot less credible.

You cannot spend $1 billion a month on infrastructure and lose the people who know what to do with it.