AWS Startup Programs, Cloud Credits, & the Real Game Behind AI Startup Funding

The cloud giants are giving away billions in free compute to AI startups, but the credits are a loss leader designed to lock in the next Anthropic before it outgrows the platform

AWS Startup Programs Are the On-Ramp for AI Companies

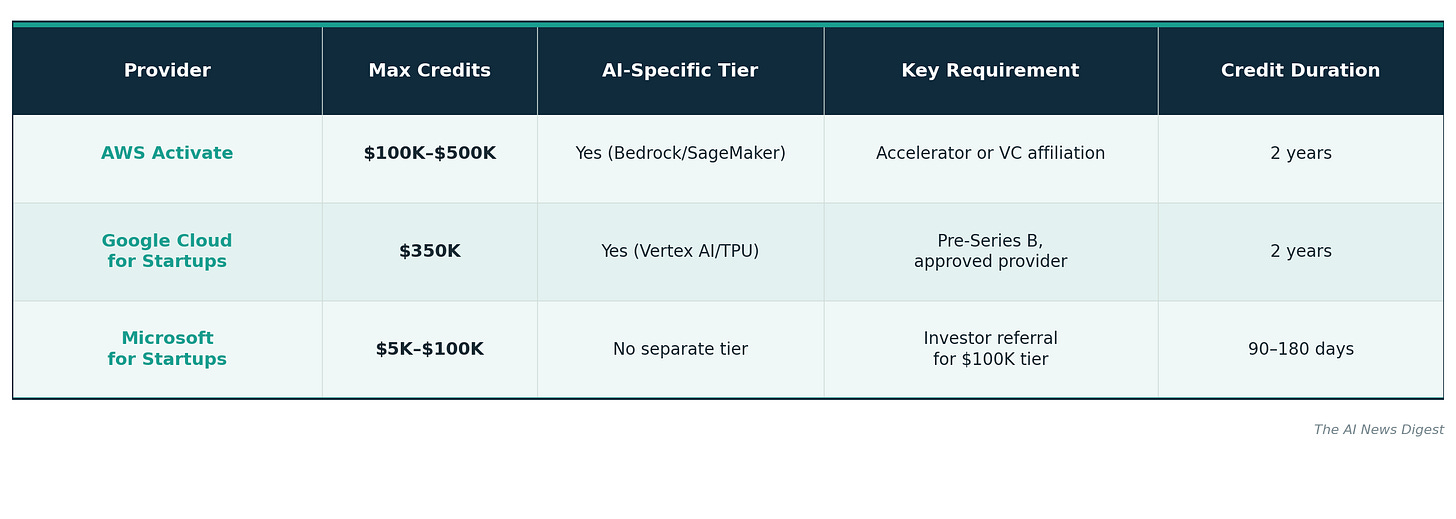

If you are building an AI startup in 2026, the first financial decision you make is probably which cloud provider’s credits to accept. AWS Activate, Microsoft for Startups, and Google Cloud for Startups all offer significant free compute to early-stage companies. The amounts vary, but the strategy is the same: subsidize startups now, collect infrastructure revenue for decades.

AWS Activate is the largest and oldest of these programs. It has two main paths. The Portfolio tier is for startups backed by a qualifying VC, accelerator, or incubator, and offers up to $100,000 in AWS credits valid for two years, plus business support and training. The Founders tier is self-serve for any early-stage startup and provides $1,000 in credits with basic support. For AI-focused startups in the Y Combinator network, AWS has extended credits to $500,000 per startup, redeemable against Amazon Bedrock, SageMaker, and EC2 GPU instances.

Since launching Activate, AWS claims to have distributed more than $6 billion in credits to startups globally, providing nearly $1 billion per year since 2020. The scale of the program is unmatched. AWS says that 80% of the world’s unicorns run on its infrastructure, and as recently as June 2024, Matt Wood, AWS VP of AI Products, cited PitchBook data showing 96% of all AI/ML unicorns run on AWS. That figure has come down to “more than 80%” as of October 2025, reflecting the rapid growth in AI unicorns and increased competition from Azure and GCP. But the pattern is clear: the credits work.

Beyond Activate, AWS committed $230 million specifically to generative AI startups in 2024, providing additional credits, mentorship, and go-to-market support through its Generative AI Accelerator. We covered the initial $300K credit announcement when it launched. The company also runs the AWS Startups Ramp program, which gives ISV partners credits to build SaaS products on AWS infrastructure. Each program funnels startups deeper into the AWS ecosystem.

How the Three Programs Compare

Google Cloud for Startups is now the most generous on paper, offering up to $350,000 over two years for AI-first startups through its Scale Tier AI track. Year one covers 100% of costs up to $250,000; year two covers 20% up to $100,000. The program also includes dedicated support credits and access to Google’s AI engineering team. Google is aggressively targeting AI startups to build on Vertex AI and its TPU infrastructure, where it has a meaningful cost advantage over Nvidia GPU-based alternatives. The program has four tiers: Start (pre-funded), Scale (early-stage), Scale AI (AI-first companies), and Scale Web3.

Google also runs the AI Futures Fund through DeepMind and Google Labs, which co-invests up to $2 million in selected startups through partnerships like Accel Atoms. Gradient Ventures, Alphabet’s AI-focused venture arm, invests $1 million to $30 million at Seed to Series A stages. The credits are just one layer of a broader ecosystem play.

Microsoft for Startups had offered up to $150,000 in Azure credits through its Founders Hub program. That changed abruptly on July 2, 2025, when Microsoft restructured the program with almost no warning. Unfunded startups now qualify for only $5,000 in credits ($1,000 initially, valid for 90 days, with an additional $4,000 valid for 180 days after verification). Investor-backed startups can access $100,000 through the new Investor Network track, but only with a referral code from an affiliated VC.

The backlash was immediate and severe. Founders who had built their entire infrastructure around Azure discovered overnight that their credit pipeline was cut. On Microsoft’s own Q&A forums, startups reported that the policy change “wrecked budgets and may sink the entire project.” One founder noted they had been actively building toward the Grow milestone ($25,000 in credits) when the announcement fundamentally changed the rules. The core problem: once you have trained models and built pipelines on one cloud, switching costs are enormous. Part of the problem, as The Register reported, was that “once you’ve actually built around Azure, switching to another platform causes a host of problems.” Microsoft said they were “evolving to better serve customers.” The founders who had been building in good faith on Azure saw it as a bait-and-switch.

ProviderMax CreditsAI-Specific TierKey RequirementCredit DurationAWS Activate$100K-$500KYes (Bedrock/SageMaker)Accelerator or VC affiliation2 yearsGoogle Cloud for Startups$350KYes (Vertex AI/TPU)Pre-Series B, approved provider2 yearsMicrosoft for Startups$5K-$100KNo separate tierInvestor referral for $100K tier90-180 days (basic)

Why Cloud Providers Subsidize Startups

The economics are straightforward. Cloud credits cost AWS, Google, and Microsoft very little relative to marginal infrastructure costs. The compute capacity exists whether startups use it or not. But the lifetime value of a startup that grows into a major enterprise customer is enormous, often generating millions per year in recurring cloud spend.

Consider Anthropic. The company started on AWS and is now Amazon’s primary AI model training partner, with Amazon investing $8 billion into the company. Anthropic uses AWS Trainium and Inferentia chips to train and deploy its foundation models. Anthropic has since expanded to all three major clouds and recently hit a $350 billion valuation. Anthropic’s cloud spend with AWS is not public, but with training costs projected to exceed $100 billion by 2029 and the company targeting $15 billion in 2026 revenue, the infrastructure bill is massive. That relationship began when Anthropic was a startup choosing where to build.

Other major AI companies that built on AWS early include Perplexity AI, which has been using Amazon SageMaker since the inception of its API service and chose AWS after evaluating several cloud providers. Stability AI trained Stable Diffusion models on SageMaker with EC2 P4 instances. Hugging Face, AI21 Labs, and Runway all run on AWS infrastructure. These companies are now deeply integrated into AWS services in ways that would take months of engineering to unwind.

The lock-in dynamic is the real product. Training an AI model on one cloud provider creates deep dependencies: data pipelines, model artifacts, inference endpoints, networking configurations, IAM roles, monitoring dashboards, and CI/CD workflows. Every integration point is a switching cost. The credits are the hook. The switching costs are the moat.

What AI Startups Actually Need to Know

The smartest startups apply to multiple programs simultaneously. You can legitimately hold credits from AWS, Google Cloud, and Microsoft at the same time, as long as you have genuine use cases for each platform. Many companies use a multi-cloud strategy specifically to maximize credits and avoid over-dependence on a single provider.

Here is a practical breakdown by use case:

If you are training models from scratch, AWS and Google Cloud offer the most compute-heavy credit packages. Google’s TPU credits can be significantly cheaper per FLOP for transformer training workloads. A single TPU v5p pod can match or exceed H100 performance at lower cost for large-scale training runs. AWS offers broader GPU options through EC2 P5 instances with H100s and is rolling out Trainium2 instances. If your training framework supports JAX, Google’s TPU path is worth evaluating seriously. If you are using PyTorch, the GPU ecosystem has better out-of-the-box support.

If you are building on top of foundation models via API, AWS Bedrock credits give you access to Claude(Anthropic), Llama (Meta), Mistral, and other models through a single billing relationship. Google’s Vertex AI offers Gemini models at what is often the lowest price per token in the market. Azure offers GPT-4o and GPT-5 through OpenAI’s API. The credit programs effectively let you evaluate these models at zero cost before committing.

If you are bootstrapped and unfunded, Google Cloud is now the clear winner at up to $350,000 without requiring investor backing. Microsoft’s $5,000 for unfunded startups is essentially a free trial, not a startup program. AWS sits in the middle, with meaningful credits available through accelerator partnerships. Some accelerators (Y Combinator, Techstars, Antler) have specific AWS credit packages that exceed the standard Activate tiers.

If you are already funded, negotiate directly. Standard credit programs are starting points. Startups with significant compute needs and VC backing can often negotiate custom credit packages well beyond the published tiers. Cloud sales teams are compensated on new logos and workload acquisition, especially for AI companies with high growth potential.

Common mistakes to avoid: Do not burn credits on expensive instance types for non-critical workloads. Use spot instances for interruptible training runs. Set budget alerts before you start, not after. Credits expire, often on hard deadlines with no extensions, so plan your compute usage calendar around expiration dates. And do not assume the program terms will stay the same. Microsoft’s July 2025 restructuring proved that credits you are counting on can disappear with minimal notice.

The Strategic Picture

The cloud credit war is a proxy for a larger battle. AWS, Azure, and Google Cloud are fighting not just for startup customers, but for the foundational infrastructure decisions that will determine where AI workloads run for the next decade. Every model trained on AWS is a model that will likely be served on AWS. Every pipeline built on Vertex AI is a pipeline that probably stays on Google Cloud.

The numbers tell you how seriously the cloud providers take this. AWS has given away $6 billion in credits. Google is offering $350,000 per AI startup. Microsoft restructured its entire program to focus resources on investor-backed companies with higher growth potential. These are not marketing expenses. They are customer acquisition costs for infrastructure relationships that can last decades.

The irony is that the startups receiving these credits are often building the AI products that will eventually compete with the cloud providers’ own offerings. Amazon invested $8 billion in Anthropic while simultaneously building its own Nova foundation models. Google offers credits to startups building on Gemini competitors. The cloud providers have decided that owning the infrastructure layer is more valuable than winning the model layer. As long as AI companies need compute, the cloud providers collect rent.

For founders, the takeaway is simple: take the credits, build on the platform that best fits your technical needs, but never mistake free compute for a free lunch. Structure your architecture so that migration remains possible. Use abstraction layers where practical. And remember that the cloud providers are playing a longer game than you are. The credits expire. The switching costs do not.

The vendor lock-in angle here is way more critical than people realize. Saw a team last year burn through their AWS credits training a model, then discover migrating to GCP would mean rewriting half their infra. The switching costs aren't just technical either, once your team learns one ecosystem's quirks (IAM policies, specific SageMaker workflows) the cognitive load of migrating is brutal even if the actual code ports cleanly.