Dario's TSMC Blind Spot, China's 400K Chip Order, & Big Tech's $475B Bet

Anthropic's CEO calls AI the biggest national security threat in a century but ignores that every leading-edge chip is made 100 miles from China

Dario Warns About AI but Not Where the Chips Are Made

Anthropic CEO Dario Amodei published “The Adolescence of Technology” this week, a 38-page essay arguing that humanity is entering the most dangerous phase of AI development.

Dario’s core prediction: by 2027, AI systems will be “smarter than a Nobel Prize winner” across biology, programming, math, engineering, and writing. He calls this a “country of geniuses in a data center.”

The essay catalogs specific threats:

AI-enabled cyberattacks and biological weapons

Authoritarian governments using AI for permanent surveillance states

Economic disruption hitting white-collar jobs hardest, with 50% of entry-level positions affected within one to five years.

Dario calls powerful AI “the single most serious national security threat we’ve faced in a century, possibly ever.” His primary policy recommendation: control the sale of advanced chips. “Chips and chip-making tools are the single greatest bottleneck to powerful AI,” he writes. Democracies should not sell advanced semiconductor technology to authoritarian states.

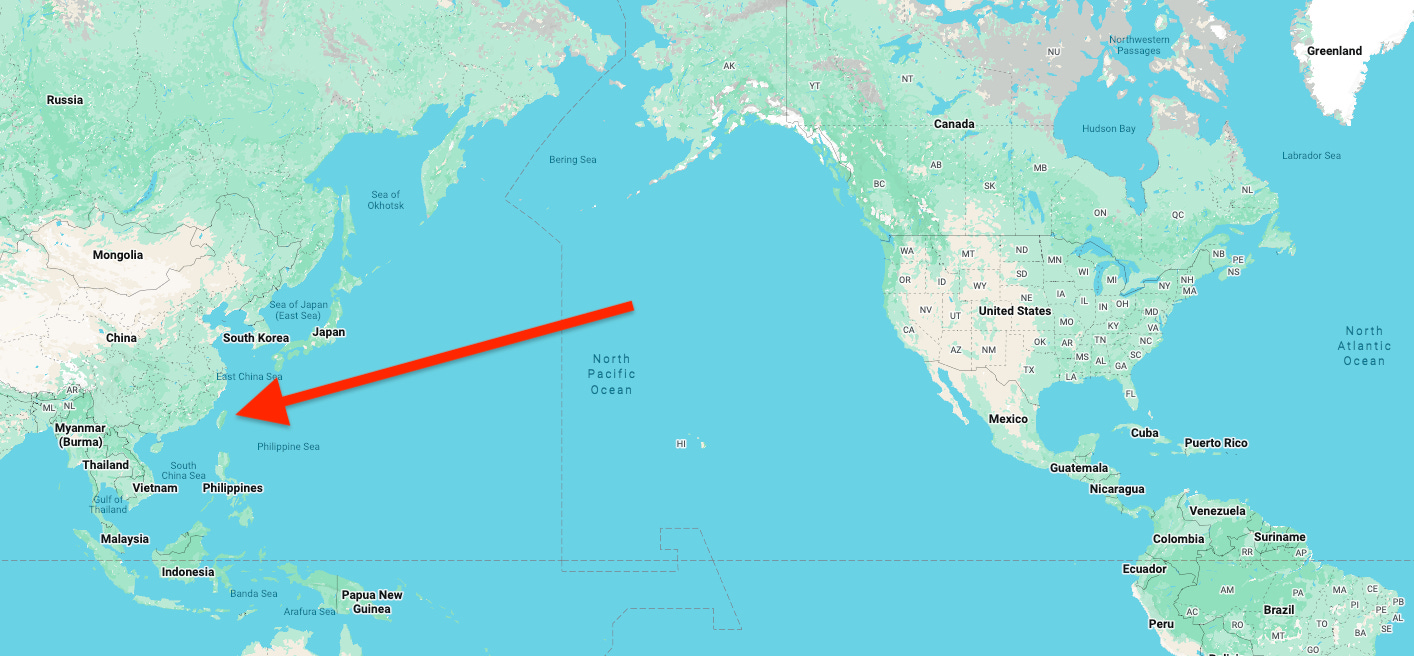

But he left out something big in that essay. If chips are the single greatest bottleneck, and AI is the single greatest national security threat, then why aren’t we worried about 100% of the world’s leading-edge AI chips being manufactured 100 miles from mainland China?

Dario focused so much on restricting chip sales that he missed the obvious: massive investment in bringing leading-edge fabrication back to the United States. Intel’s fabs in Arizona and Ohio are years behind TSMC’s best nodes. We wrote last week about how C.C. Wei dismissed Intel as a credible competitor. If Dario genuinely believes AI is an existential national security risk, the U.S. cannot afford to depend on a single Taiwanese company for the only input that matters.

Another theory could be that Dario is talking his book. If Nvidia redirected the fab capacity it uses for Chinese orders, more chips would be available for Anthropic. Their training costs are projected to exceed $100 billion by 2029, and the company is targeting $15 billion in 2026 revenue.

In 2023, AI safety was the dominant narrative. By 2025, the pendulum swung to AI opportunity. Now, it’s all about demand far outstripping supply.

China Greenlights 400,000 Nvidia H200 Chips as Jensen Visits Beijing

China approved ByteDance, Alibaba, and Tencent to collectively purchase more than 400,000 Nvidia H200 AI chips. The approvals came during Nvidia CEO Jensen Huang’s visit to China this week, his first major trip since the Trump administration cleared H200 exports with a 25% surcharge in December.

Chinese companies have submitted orders for over 2 million H200 chips for 2026 delivery, but Nvidia currently has only about 700,000 units available. We wrote last week about TSMC being the bottleneck limiting AI growth, and all of these unfilled order are revenue that Nvidia will never see.

At roughly $27,000 per chip, the initial 400,000-unit batch represents nearly $11 billion in revenue for Nvidia. And that is before the rest of the Chinese market gets approval.

The H200 delivers roughly six times the performance of the H20, the chip Nvidia had been selling in China under previous export restrictions. While Huawei’s domestic chips now rival the H20, they lag far behind the H200. Chinese AI companies know the difference. The demand signals that Beijing’s self-reliance strategy has limits when the performance gap is this wide.

But the approvals come with strings attached. Beijing is reportedly considering requiring each H200 purchase to be bundled with domestic chips at a set ratio. The U.S. Commerce Department has its own cap: exports to China cannot exceed 50% of what Nvidia sells to U.S. customers. Between the 25% tariff, the bundling requirements, and the export caps, the final volume that actually reaches China could be significantly lower than what was ordered.

Nvidia’s China market share has collapsed from over 90% in 2022 to an estimated 10% in early 2026. Jensen has said the Chinese market could be worth $50 billion per year, and none of those sales are currently in Nvidia’s forecasts. This approval is Beijing signaling that it is willing to pay the premium for now, even as it builds domestic alternatives.

The real question is what happens when Nvidia’s Blackwell generation arrives. The H200 is already two generations behind Nvidia’s upcoming Rubin architecture. The 18-month technology lag was part of the Trump administration’s justification for allowing exports. If China is this hungry for two-generation-old chips, it tells you how far behind Huawei actually is.

Big Tech’s $475 Billion AI Bet Meets the TSMC Bottleneck

Meta and Microsoft both beat expectations in earnings. But the numbers that matter are the ones they haven’t earned yet.

Meta guided 2026 capital expenditure to $115 billion to $135 billion, which is basically all of their free cash flow. It doubles the $72.2 billion spent in 2025.

Zuckerberg told analysts that 2026 would be a “major AI acceleration” year, with Meta targeting 1.3 million GPUs and 1 gigawatt of data center power by year-end. The spending is primarily directed at Meta Superintelligence Labs, the team that delivered its first internal models in January.

In their earnings, Microsoft shared that demand backlog more than doubled to $625 billion. They also disclosed that capacity constraints will persist through at least June. The backlog is growing because they cannot build fast enough. Every quarter of constraints is revenue Microsoft will never get back.

Combined, Microsoft, Meta, Alphabet, and Amazon are expected to spend roughly $475 billion in capex this year, up from $230 billion in 2024. Add in the broader ecosystem and Gartner projects global AI spending will hit $2.5 trillion, up 44% from 2025.

And spending is only half the problem. We wrote last week about TSMC being the single bottleneck limiting AI growth. C.C. Wei admitted new fabs won’t contribute meaningful capacity until 2028-2029, and that investment doesn’t look like enough.

Meta is spending all of its free cash flow because it believes it is irrelevant without AI. Microsoft has $625 billion in signed contracts it cannot fulfill. The demand is proven, the supply is not there, and the only company that can fix that is TSMC.

But as we wrote last week, until Intel and Samsung catch up, why would they take on the risk?

pretty interesting update this time. the numbers we are seeing is still super impressive in this space

The semiconductor dynamics between the US and China keep getting more complex and worth following closely.